What is it? Thinking that house prices will always go up. This thought can handicap you financially even if…

your thinking is hedged with the caveat … “House prices will always go up … over the long haul.” It’s amazing how many people think this is true. If you are one of them, read on, because this can be turned into a powerful advantage. I’m going to illustrate my point with an example.

In 2006, Mr. X bought my apartment for $490,000. My apartment is currently under contract for $647,250. On the surface, it looks like, if he held onto the apartment, he would have made $157,250 proving the theory that housing prices always go up. But numbers are tricky, and they can tell many stories.

To see the reality of how much Mr. X would have walked away with, we have to dig a little deeper. First, when he bought the apartment it was completely dated. (Don’t take my word for it, check out this pic.) The selling price reflects the premium of a completely renovated apartment.

The renovations included the bathroom, kitchen, and new floors throughout the apartment. I was quoted, at Home Depot, that the bathroom renovation cost would be $25,000. (I know this sounds crazy. I went to several places for a quote. Home Depot was the cheapest!) Home Depot quoted the kitchen renovation at a minimum of $30,000. The oak floors cost $11,000. Lastly, it cost $1,500 to paint the apartment before listing it. These renovations would have cost $67,500, bringing his cost basis (how much he put into the apartment) to $557,500. ($490K purchase price + $67,500 in renovations = $557,500.)

Okay, you say, but even with all the renovations he still made $89,750.

Not so fast. He has to sell the place first. In Manhattan, it costs 6% of the total purchase price to have a real estate agent sell your property. This cost comes in at $38,835. Plus, there is a flip tax, a fee that gets paid back to the building when you move out. This fee can be as high as 4% of the selling price, but since Mr. X lived there more than 4 years, he only has to pay 1%, or $6,472. Lastly, he has to hire a lawyer to draft up the sales contract, which costs $2,500. After factoring in these costs, Mr. X’s take home loot is $41,942.

“Well, it did go up. He made almost $42,000,” you say.

Yes. Technically that’s true. But there is one more factor you have to add in, which is opportunity cost. Opportunity cost is the loss of potential gain from other alternatives when one alternative is chosen. Meaning when Mr. X decided to purchase an apartment, he lost the opportunity to invest in something else. So, what if he decided to invest in something?

To see how well Mr. X did through the eyes on “a good investment,” we have to calculate his rate of return. If he put down 20% on the apartment, the minimum you can put down in Manhattan, his return would be 3.63%.*

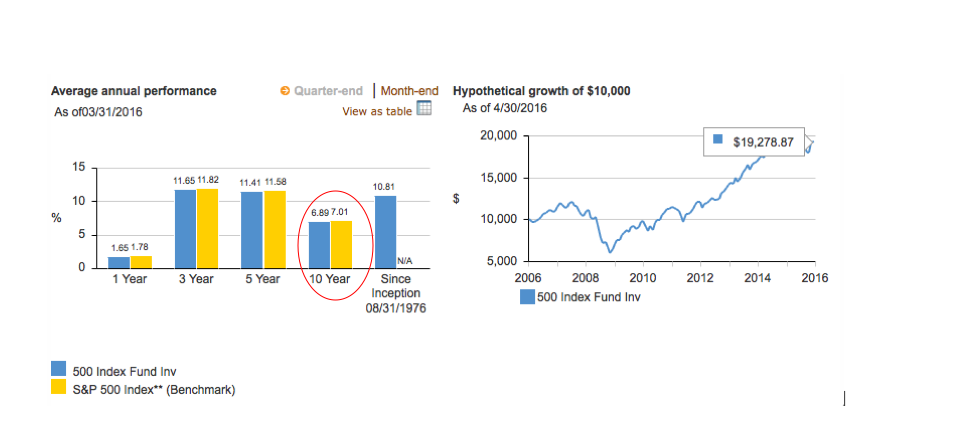

To see how this stacks up to other investments he could have made, I will compare it to the S&P 500. The S&P 500 owns shares in big American companies like Apple, Johnson & Johnson, and Facebook. This investment made a return of 6.89% over the same period of time. This means, if Mr. X invested in the index fund, instead of putting 20% down on his apartment, he would be walking away with $91,207 * instead of less than $41,942.

So, if you are looking at it as investment, Mr. X lost $49,265 because he invested in the house.

Now, I know you can’t snuggle up to an index fund, and owning an apartment is not necessarily about “making money.” That’s why I suggest when you’re buying one don’t let the idea of it “going up in value” influence your purchasing decision.

It’s also important to note that Mr. X does not live here. Maybe he did want to hold onto it for the long haul, but he was forced to sell in 2009. I don’t know the exact price he sold at, but I do know that he sold at a considerable loss. (Considerable loss is defined as $100,000 or more.)

The take-away: do not buy your house because you expect it to go up in value. Don’t even let it be an influencing factor. This is what gets people in trouble. Life is unexpected. Mr. X was forced to sell at the worst time. He isn’t the only “unlucky” one. The 2008 financial crisis had millions defaulting on their homes. And many more are currently “stuck” in ones they no longer want because they went down in value and still haven’t come back!

Instead, expect your abode to cost you money, in taxes and maintenance. Looking at buying through this lens might make you more conservative in your purchasing decision. Then if it happens to go up in value, you have a wonderful, unexpected gift.

Like what you’re reading? If so, subscribe to have future money tips, tricks, and inspiration delivered to your inbox from your virtual financial advisor. (Just scroll to the bottom of this page. )

*Does not factor in taxes