Have kids? Want them to never have to worry about money? Then don’t give them anything, birthdays and holidays aside. Let me show you what I mean. I will start at the beginning and describe the situation through your own eyes.

Invest NOT Earn

Most adults are stressed out about money. And, why is that? Well, in a nutshell, because you have never been taught how to invest and make your money work for you. You have been taught how to get a good job, and from there on, the assumption is that the rest should take care of itself. But that will only work for a handful of super high-paying jobs. It is very difficult to earn yourself rich. It’s much easier to invest yourself rich!

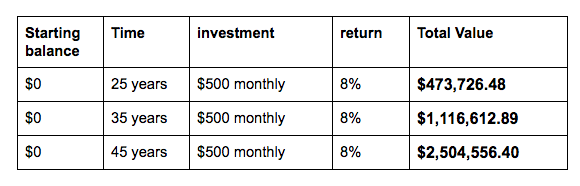

Look at the diagram below. What do you notice? Even though you invested the same amount of money monthly, and, earned the same rate of return, you got wildly different outcomes when you changed the timeline.* It’s time that makes the fortune. Not how much is invested or your rate of return. Time is the most important factor.

Start Investing ASAP

To a lot of adults, this information will look dismal since most don’t start investing until they are in their 30s or 40s. Who cares if you have have $2.5 million at age 85? That’s not motivating at all! But imagine, if we were looking at these numbers through your child’s eyes. If you started learning about investing when you were four, you would have had one heck of an advantage. Your child could have easily have a net worth of a million dollar by forty. What’s even more important is that they would know how to manage and grow their fortune!

So, if you want your child(ren) to not have to stress about money as an adult, start teaching them now. Children love learning about money. Money has distinct components such as; numbers and formulas, but it’s the habits that create the fortune. For example, you don’t need to teach a kid about gingivitis for them to have healthy teeth. You only need to inculcate in them the habit of flossing and brushing twice a day! The same is true with investing, encourage habits that build the fortune.

Let me show you how I teach my son, Jack. He’s four. To start, I employed the principle of delayed satisfaction. Simply put, that’s what investing is all about. Giving up a little today, for a lot tomorrow. (This is very hard for lots of grown adults to do. Just remember the sway of the sale!)

There are countless examples of how you can do this in your everyday life. The more you employ this principle, the better your child will be at investing. A couple of examples of delayed satisfaction include: a lollipop after the haircut…buying a treat at the grocery store but waiting till after dinner to get to eat it.

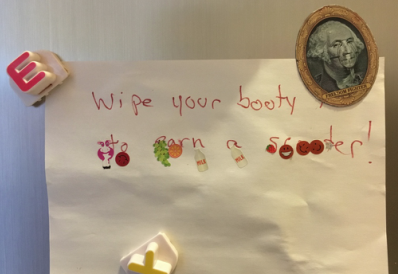

Ideally, you want to extend the timeline between work and reward. When extending the timeline, I use stickers and visuals to show Jack his progress. Here’s a picture of what I have on my fridge right now.

With children, there are so many milestones that there is always something to work towards. Jack just entered pre-K, and, for him to do that, he had to learn to wipe his own booty. So, once he does it, perfectly 20 times, he earns some trucks for his soldiers. He loves getting a sticker and counting how many more he needs!

He has been working on it for a month and is about to claim his prize. Does this sound like too long of a timeline to you? If it does, you can start with smaller timelines, but I encourage you to build up to it with very extended timelines. Jack only has excitement around this, not frustration and that's because we started early!

Just in case you’re wondering where I came up with this important principle, the truth is I stumbled upon it. Over the last seven years, I have noticed a pattern in my clients who struggled the most. Every single one of them without exceptions said that their parents “gave them everything they ever wanted. Eventually.”

The interesting thing was that the commonality between their parents was the only factor they all shared. That’s where the similarities ended. They came from all types of families; wealthy families, middle-class families, and strapped-for-cash families. The earning power of these clients ranges from $50,000 to $250,000. But, all of them, without exception, had trouble holding on to their money, vanquishing the opportunity to invest.

So, end the financial stress forever, at least for your kids. It doesn’t matter what age your kids are right now. It’s never too late to start. Of course, this is only the beginning. Becoming a master investor is no more difficult than learning this very first principle.