A good credit score can make you a lot of money by getting you access to the best interest rates.

Why is Your Credit Score Important?

On a 30-year fixed mortgage for $300,000, getting a rate only half a percent lower can save you $30,640 over the life of the loan. And that’s just one example; there are a number of ways to use your credit to your advantage, but first you need the score. So, let me guide you through the steps of getting it.

What Credit Score Do You Want?

First, to qualify for the best rates, you need a score of at least 740. Your credit score is always fluctuating, as it gets recalculated every 30 days. Therefore, I like to add a margin of safety and recommend you aim for 770 or higher.

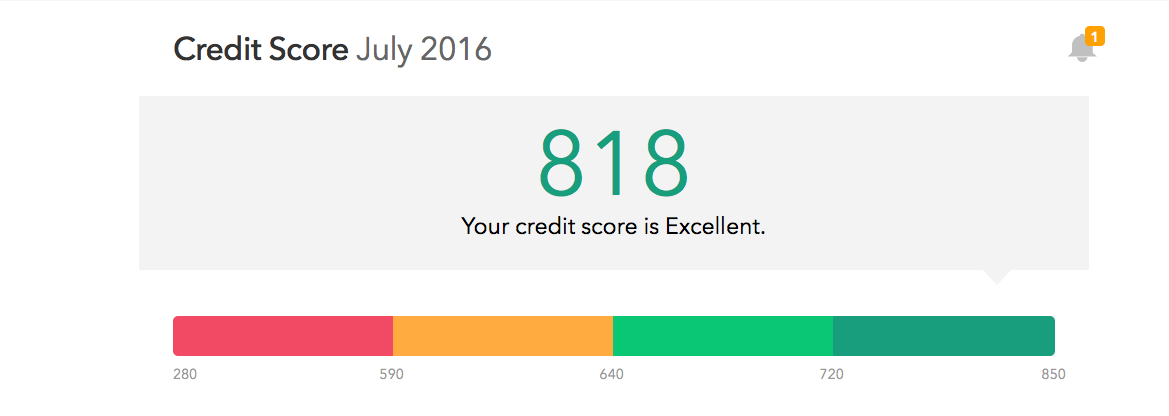

So, how do you get that great score? It is actually quite simple. There are a plethora of misconceptions about credit, but if you follow these golden guidelines, and add nothing else, you will hit the best rate jackpot. To show you that I know what I’m talking about, here’s a screenshot of my current credit score on Mint.com. (They allow you to see your score for free, I highly recommend it!).

Factors Influencing Your Credit Score

There are five factors that are used to calculate your credit score, but three of them are of prime importance. The first is: paying on time. To have amazing credit, you have to pay on time. All the time. Even if you pay only a couple of days late, it can really ding your score. I highly recommend putting all your credit cards on autopay and creating a Google reminder a couple of days before each payment is due to ensure the payment gets made ahead of the due date. You cannot have excellent credit if you don’t follow this rule like the gospel.

Now, it’s not important how much you charge. The only important factor is that you generate a statement. This means that you could charge only one item on your credit card each month, and it would be exactly the same as if you charged a 100 things. The number of times you swipe your card does not affect your credit, but it does affect the probability of you creating debt. Generating a statement allows you to produce what the credit companies score you on: your promise to pay.

I recommend adding a recurring bill, like your cell phone, to be paid automatically by your credit card. Then you would not have to think about it. You would be naturally building great credit. You don’t need to do this with a lot of credit cards. Credit cards companies, and even credit agencies, appreciate having a lot of accounts. But two credit cards, a phone bill, and an electric bill in your name are sufficient. Having a number of different credit lines will only add a few nominal points to your score, but the reality is you’re more likely to create debt or forget to pay a bill if you have many cards. I only have two credit cards and my credit rocks!

Debt to Credit Ratio

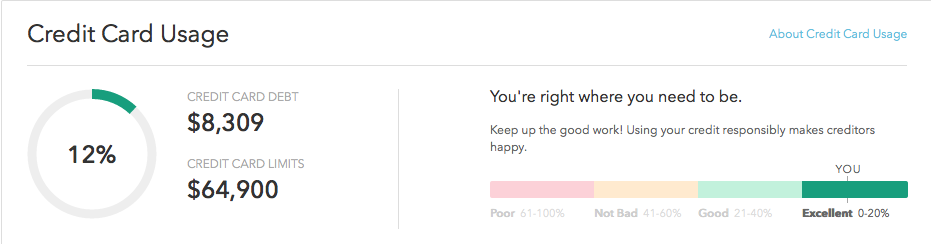

The second critical factor in calculating your credit score is your debt to credit ratio. To calculate this you divide how much credit you are using, on all your credit cards, by how much you have available, on all your credit cards.

All balances on all credit cards / All limits on all credit cards = Debt to credit ratio

For example: Let’s say I have two credit cards. The first one has a credit limit of $10,000 and a balance of $4,000. And the second one has a credit limit of $3,000 and has a balance of $2,400.

To figure out my debt to credit ratio, all you have to do is add up what you owe on your credit cards. In this case it’s $6,400. Then add up all the credit you have available. In this case $13,000, and divide the two.

$6,400/ $13,000 = 49%

In this example, the debt to credit ratio is 49%. This ratio would hurt your score. When your debt to credit ratio is 30% or higher, your credit score starts to suffer. This is golden rule number two: you must keep your credit utilization under 30%. (For a 800+ credit score, it has to be 20% or less.) Also, be aware that your scores are recalculated every month. Since you don’t know what day they are are recalculated, you want be conscious of your calculations at all times.

Don't Change Your Credit Cards

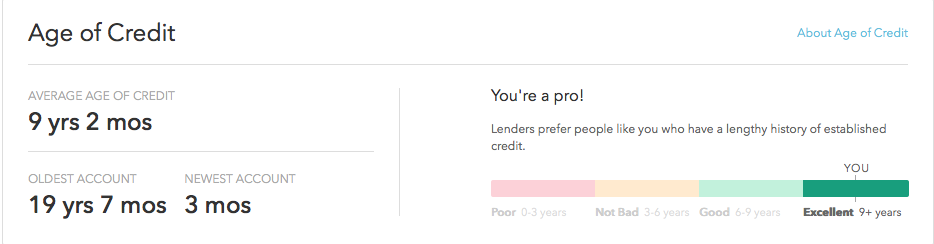

Lastly, you want to keep your two credit cards forever. You don’t want to open or close them. Why is this important? A good way to think about it is to imagine you had a credit card for ten years that you paid on time every single month. That would be 120 times, in a row, that you proved that you paid on time. Would you lend money to someone like this? What do you think the chances would be of getting your money back? Pretty darn high, right?

Now contrast it to a person who only kept their credit card for one year. They are always chasing the offers. Their credit report would show that they paid 12 times, in a row, on time. What person would you rather lend money to? Someone who has proven that they can pay 12 times in a row, or someone who has proven that they can pay 120 times? This is why the highest scores go to people who keep their cards.

Recap

To recap, here’s the “love your credit score” checklist:

- Open two credit cards that you want to keep forever.

- Pay one recurring bill with each card.

- Set the credit card to be paid automatically.

- Remind yourself that payment is coming out two days in advance with Google reminders.

- Keep an eye on your debt to credit card ratio. Make sure it stays below 30%.

If you do this, and nothing else, it will be just a matter of time before your credit increases!