Strategic financial solutions to grow profits, ease stress and thrive.

Making millions but still sweating every payout, ad bill, and invoice?

You work like hell. Your team and friends think you are crushing it. But the pressure from investors is mounting and your bank account tells a very different story.

You are not alone. Most 7-figure Shopify founders are secretly broke, bleeding cash, hiding from their CFO (or worse, do not have one), and praying the next launch covers the bills.

As a Fractional CFO for 7-figure Shopify stores I’ve uncovered $50K–$200K in hidden cash leaks in just 30 days.

No drastic changes. Just fix the hidden leaks keeping you stuck instead of scaling profitably.

“Real Founders. Real Money Found.”

These are just two examples of what the "show Me the Money Audit" uncovers

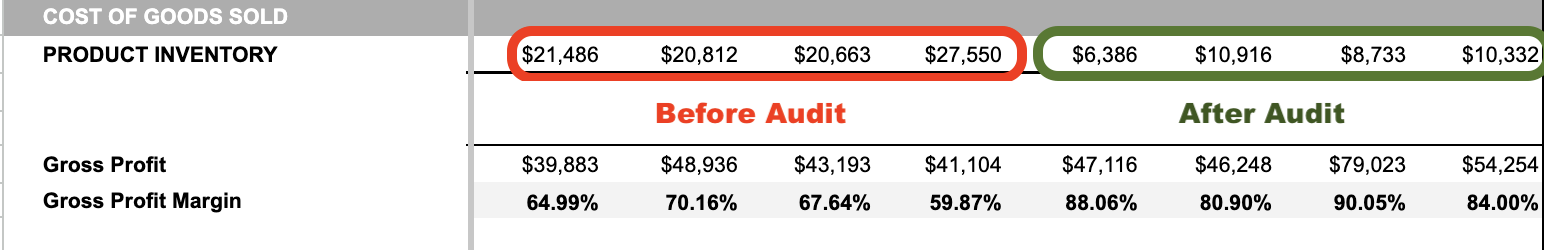

Inventory Overhaul → Profit Surge

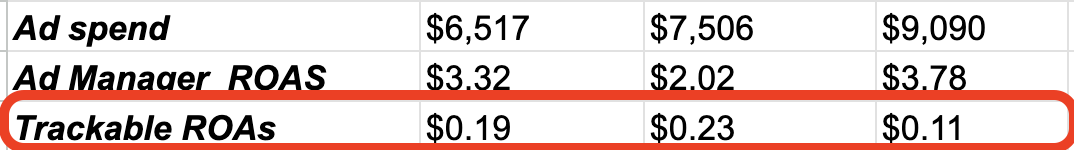

Ad Spend Audit → $84K Wasted Spend Found

The average founder leaks $50K-$200K annually without knowing it. The audit finds it.

Imagine logging into your account and watching the cash stack up.

You breathe deeper. You sleep through the night. You finally scale with confidence.

You built something incredible, but nobody builds everything alone. This is the part you no longer have to carry.

What You Get

Cash Leak Audit → More Money in the Bank

We’ll uncover at least $50K in annualized leaks. Guaranteed or you don’t pay.

Cash Flow Dashboard → Instant Breathing Room

A simple, visual view of your runway, trends, and predictability. No more spreadsheet chaos.

Action Menu → Control Like a CEO

Exact next steps ranked by ROI so you focus only on what moves the needle.

60-Minute CFO Deep-Dive Call → White-Glove Guidance

Live Zoom walkthrough of your results showing where money is leaking, how you compare to peers, and what to fix first. A premium CFO-level experience, not just a report in your inbox. You leave with a clear roadmap and the option to have me help implement it.

Exclusive Bonuses

Important: Because this audit is a full CFO-level overhaul, I only take 1 founder per month. When the slot is booked, the next opening will not be until next month.

Investment

Most 7-figure Shopify founders are leaking $50,000 to $200,000 a year without even knowing it.

The Show Me the Money Audit uncovers those leaks in 30 days and gives you a clear roadmap to stop the bleeding.

Your Investment: $5,000

Your Return: $50,000 to $200,000 in hidden cash. Guaranteed or it’s free.Important: I only take 1 founder per month. Once the slot is gone, the next opening will not be until next month. And in Q4, when Shopify brands either print money or bleed it, spots go fast.

You were never meant to do this alone

You’re working hard enough! A fractional CFO takes the pressure off organizing financial data and developing a strategy that achieves your vision. But don’t take our word for it, here’s what our clients had to say about their experience:

This Ecommerce company started with debt, from starting the company, and were experiencing very fast growth. They didn’t know the best steps to capture the opportunity. 6 months later they erased all start up debt, fixed their dead stock problem, took their gross profit margin from 61% to 80% allowing them to hire a COO, give to charity, afford paid ads, and enjoy steady income stream.

Stacy

Andrew

How I Got Started (and Why I Love What I Do)

It all started at a café in New York City, where my husband—owner of a Skinbar a NYC med spa—looked up from his espresso and said, “I need to come up with $25,000 by next Thursday to pay off the credit card.”

As a Certified Financial Planner, that sentence lit a fire in my nervous system.

He was doing what many founders do: making sales, yes, but juggling cash flow with guesswork, slashing prices just to make payroll, and making short term decisions that hurt long term growth. His talent was undeniable, but finance wasn’t his superpower. That’s where I stepped in.

At the time, I was running my own financial practice, helping individuals and small businesses with monthly money check ins, budgeting, forecasting, and strategic planning. Naturally, I started doing the same for him, because let’s be honest, our ships were tied together, and this situation was giving me hives.

In 2012, I suggested a subscription style model to stabilize cash flow. It was unusual at the time, but within a month we had over 87 members, and that stability, along with premium pricing bundles we built together, carried the business through rocky seasons and laid the groundwork for growth.

That experience changed everything. Read more...

Frequently Asked Questions

A fractional CFO is a financial executive who provides part-time CFO services to businesses. They offer high-level financial expertise and strategic guidance without the cost of a full-time CFO.

You might need a fractional CFO if:

- Sales look strong, but cash feels tight.

- Finances feel overwhelming or unclear.

- You’re ready to scale and need smart investment guidance.

- You want to maximize value before selling your brand.

If you’re thinking “I look successful, but feel broke” — it’s time

According to Salary.com, the average salary for a Chief Financial Officer (CFO) in the United States is around $430,000 per year. Fractional CFOs, however, can cost as little as 10% of what you’d pay for a full-time CFO, making them a more affordable option for businesses seeking high-level financial guidance.

A fractional CFO helps you stop the constant cash leaks and finally keep more of what you earn. They tighten expenses, boost profit margins, and forecast cash so you’re not blindsided by payroll or tax bills. They give you clear, founder-friendly guidance on when to invest in inventory, hires, or growth so scaling doesn’t feel like guesswork.